Protecting crypto wallet private keys and transactions with a biometric card

Financial inclusion—beyond the use of cash—is a top priority for central banks throughout the world, yet 1.7B people still do not have access to a bank account today.1 To address this challenge, central banks are exploring an alternative to cryptocurrency called Central Bank Digital Currency (CBDC). The IDEMIA secure wallet solution for offline CBDC transactions has been designed to help them in this ambition.

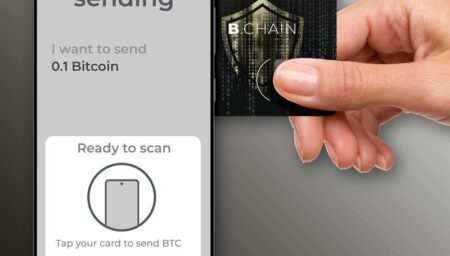

Built to enable an ideal banknote exchange for Central Bank Digital Currency, the IDEMIA secure offline CBDC wallet makes a highly secure digital cash experience truly available to everyone and at any time. This secure wallet allows a user to make consecutive digital offline payments with immediate settlement. The CBDC wallet user can initiate offline payments using any channel: contactless, email, QR Code, and the same terminals and standards currently used for card payments. The offline CBDC payments can be received by any device (secured or not), with or without an internet connection to the ledger.

To enable offline CBDC payments the IDEMIA secure wallet solution leverages tamper-resistant certified hardware chips—such as the ones already widely used for EMV payment cards, ID documents, and other critical applications. The use of such government-grade hardware chips allows balance management, Federal Reserve policy implementation, user authentication, and key storage. To further enhance payer protection, the secure wallet can integrate biometric authentication while maintaining transaction privacy.

This secure wallet payment solution also allows central banks to address another important issue: resilience. It discharges the network from unnecessary transactions and reduces the load on servers, thus allowing larger transaction volumes to be processed.

At IDEMIA, we believe everyone should have access to financial services—even without a bank account or when a connection is not available. Already used in proofs of concept with European central banks, our offline CBDC payment solution enables central banks to act now to extend digital cash capabilities to everyone.

1 Source: World Bank 2017

IDEMIA secure wallet solution works with smartphones, of course, but also feature phones, biometric payment cards, SIM technologies, wearables and even connected machines—making Central Bank Digital Currency truly available to everyone and everywhere.

The hardware security mechanisms of IDEMIA secure wallet prevent fraudulent money creation and double spending. All offline CBDC payments can optionally be logged, including the digital identity of the payer to apply anti-money laundering controls.

The use of secure hardware chips allows the central bank to enforce their privacy protection rules, such as by applying a privacy profile hiding the identity of the payer as long as the offline CBDC payment does not exceed a certain amount.

Central Bank Digital Currency (CBDC) explained

This infographic shows how CBDCs are redefining payment eco-system fundamentals as global trends show a shift towards digital and cashless societies.

Latest News