Securing online payments

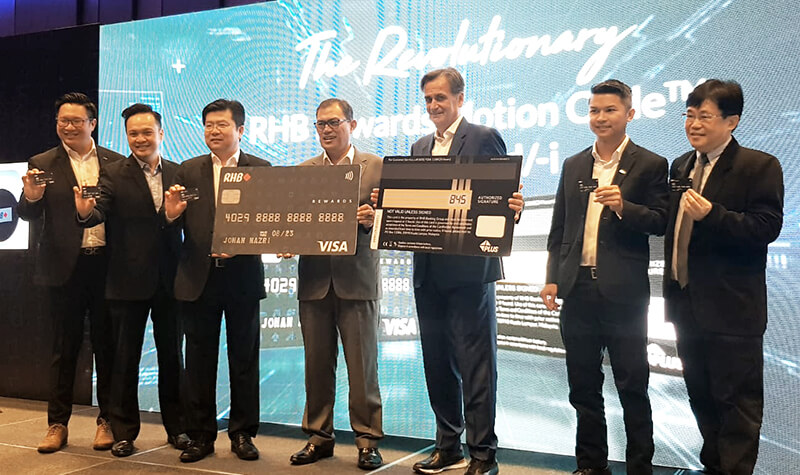

RHB Banking Group (RHB) partners Visa and IDEMIA to introduce the first-of-its-kind RHB Rewards MOTION CODE™credit card in Southeast Asia. It is a high-tech payment card with a dynamic card verification value (CVV) security code, which will automatically refresh regularly. This cutting-edge technology is the latest feature embedded in the new RHB Rewards Motion Code™ Credit Card.

RHB Banking Group (RHB) partners Visa and IDEMIA to introduce the first-of-its-kind RHB Rewards MOTION CODE™credit card in Southeast Asia. It is a high-tech payment card with a dynamic card verification value (CVV) security code, which will automatically refresh regularly. This cutting-edge technology is the latest feature embedded in the new RHB Rewards Motion Code™ Credit Card.

This technology is set to prevent credit card fraud and hackers from accessing important data and disrupting transactions. The RHB Rewards Motion Code™ credit card replaces the static card verification value (CVV) code printed on the back of credit cards today with an e-paper mini-screen, which displays a dynamic security code.

In a 2018 report by Bank Negara Malaysia (BNM), the majority of payment card fraud cases in Malaysia involved credit cards, which accounted for 92.1% of total fraud losses. Payment card fraud is mainly contributed by card-not-present (CNP) fraud such as unauthorised online transactions using stolen PIN numbers, CVV code and identity theft.

RHB is proud to be at the forefront of fraud prevention in Malaysia. In our efforts to curb fraud, we continue to pursue innovation in line with our aspirations to be a digital-centric bank by 2022. By partnering with Visa & IDEMIA, we have been able to leverage on best-in-class security features to safeguard our customers’ financial resources. This card provides a complete end-to-end solution for RHB as an issuer and for our cardholders. In our pursuit to create superior experiences for our customers, this technologically-driven card creates a secure space for our customers when making financial transactions.

Nazri Othman, Acting Head of Group Retail Banking, RHB Banking Group

We are focused on taking the lead to innovate and strengthen payment security in Malaysia, and believe that it is a shared responsibility amongst banks, consumers and the government to secure the commerce ecosystem. With this solution that we have built together with RHB, we can help increase online transactions, and prevent fraudulent transactions at the same time, where fraudsters attempt to use stolen card data to make purchases. Today, we are creating innovative products and solutions for Malaysians with our valued partners, and striking a fine balance between security and innovation, which will help build confidence and trust in the payments ecosystem. This is crucial for the growth of electronic payments in the country, and Malaysia to become a more digital nation.

Ng Kong Boon, Visa Country Manager for Malaysia

Security and trust are the foundations of innovation at IDEMIA, and Motion Code™ technology is a result of implementing them. With zero changes required in user habit, Motion Code™ is a pioneering technology designed to prevent any online fraud and ensure seamless transactions.

Vincent Mouret, SVP APAC Financial Institutions from IDEMIA

This technology relies on a complex algorithm to automatically generate a new code, and does not require any disruptive process such as installing a plugin or having to key in additional data. RHB targets to issue 21,000 new RHB Rewards Motion Code™ credit cards per year. Cardholders stand to enjoy unlimited rewards points for cinema, overseas spending, online purchases, exclusive golf privileges, as well as health, insurance and shopping spend, among others. Customers will also receive a waiver of annual fees on the first year.

Issued on behalf of RHB Bank Berhad by Group Corporate Communications Division. For more information, please contact Norazzah Sulaiman at 603-9280 2125/ norazzah@rhbgroup.com or Cynthia Blemin at 012-249 4071/ cynthia.blemin@rhbgroup.com. For enquiries in regards to banking, products and services please contact our Customer Care Centre at 603-9206 8118.

About us - IDEMIA, the global leader in Augmented Identity, provides a trusted environment enabling citizens and consumers alike to perform their daily critical activities (such as pay, connect and travel), in the physical as well as digital space.

Securing our identity has become mission critical in the world we live in today. By standing for Augmented Identity, an identity that ensures privacy and trust and guarantees secure, authenticated and verifiable transactions, we reinvent the way we think, produce, use and protect one of our greatest assets – our identity – whether for individuals or for objects, whenever and wherever security matters. We provide Augmented Identity for international clients from Financial, Telecom, Identity, Public Security and IoT sectors.

With 13,000 employees around the world, IDEMIA serves clients in 180 countries.

About RHB Banking Group - RHB Banking Group, with RHB Bank Berhad as the holding company, is the fourth largest fully integrated financial services group in Malaysia.

The Group’s core businesses are structured into seven main business pillars, namely Group Retail Banking, Group Business & Transaction Banking, Group Wholesale Banking, RHB Singapore, Group Shariah Business, Group International Business and Group Insurance. Group Wholesale Banking comprises Corporate Banking, Investment Banking, Group Treasury & Global Markets, Asset Management and Private Equity. All the seven business pillars are offered through the Group’s main subsidiaries – RHB Investment Bank Berhad, RHB Islamic Bank Berhad and RHB Insurance Berhad, while its asset management and unit trust businesses are undertaken by RHB Asset Management Sdn. Bhd. and RHB Islamic International Asset Management Berhad. The Group’s regional presence now spans ten countries including Malaysia, Singapore, Indonesia, Thailand, Brunei, Cambodia, Hong Kong/China, Vietnam, Lao PDR and Myanmar.

For more information, please visit www.rhbgroup.com

About Visa Inc. - Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive.

Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit www.visa.com.my

IDEMIA - Havas Paris PR Agency

+ 33 6 63 73 30 30

idemia@havas.com