From unbanked to cardholder – the path to economic growth

Replacing cash with card payments doesn’t just make the everyday life of consumers easier, it also fosters economic prosperity.

From unbanked to banked…

About 1.7 billion people around the world today are unbanked, roughly one in three adults1. Unbanked means having no access to fundamental financial services such as savings, transfers, lending and deposits. Even in the United States, one of the richest countries on the planet, 25% of the population is unbanked or underbanked2. But the situation is evolving fast: the unbanked proportion of the world’s population decreased from 51% to 33% between 2011 and 20203.

… via mobile money

Historically, being banked means having an account with a “traditional” bank. Yet despite positive developments in recent years, this still isn’t an option for many people in developing countries. For these populations, the only way of storing excess cash is hiding it in their homes. But considering two thirds of the world’s unbanked own a mobile phone5, “mobile money” services represent a significant opportunity for the acceleration of their transition towards becoming banked. These services enable users to transform cash into mobile credits through intermediaries such as the local grocery store. By transforming cash into mobile money, unbanked populations can gain access to financial services for the first time and enjoy the benefits of financial inclusion.

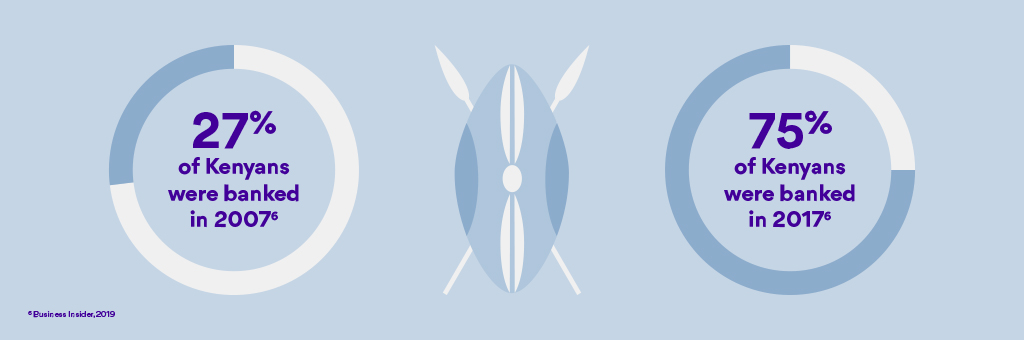

An illustrative example is the success of the M-Pesa mobile money service in Kenya. When it was launched in 2007, 27% of Kenyans were banked. By 2017, that figure had risen to 75%6.

From mobile money to payment cards

Many of these mobile money providers extend their services to in-store payments, but they encounter one of the most fundamental challenges faced by new forms of payment: creating acceptance. It’s very hard to convince merchants to accept a new payment method, not the least if multiple proprietary mobile money services are available on the market. To overcome this hurdle, more and more mobile money providers are teaming up with payment card schemes. For example, when e-wallet giant Grab (the “Uber of southeast Asia”) announced it would attach a physical Mastercard card to its app, this suddenly meant its users would be able to use their GrabPay credits with any of the 47 million merchants worldwide accepting Mastercard – instead of being limited to the much small number accepting GrabPay.

From an ID document to payment capabilities

Another path for helping unbanked or underbanked populations to transition to payment cardholders and gain faster access to financial services is to couple a prepaid payment card with their governmental identification. This is what is being developed in the United States with the Converged Card, a state-issued driver’s license or identification with a payment credential. This solution aims at bringing more people into the formal economy, providing them with a convenient and secure payment means. It will allow the U.S. government to reach people faster by supporting state-subsidized programs such as unemployment benefits, housing and utility assistance, as well as tax refunds.

From cash to card: facilitating economic prosperity

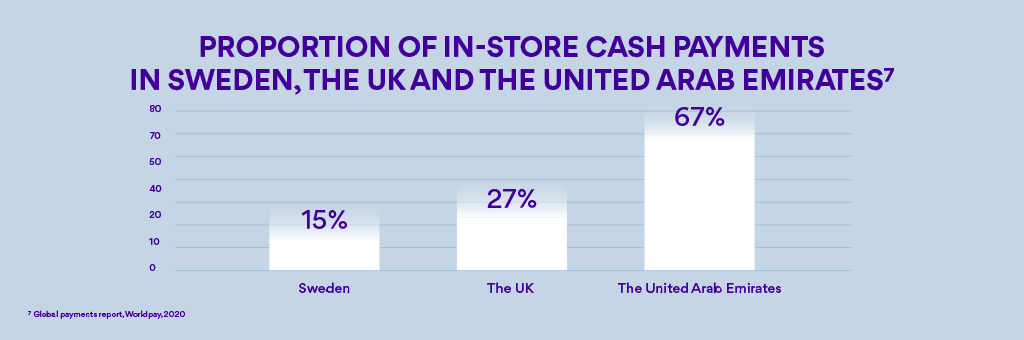

One consequence of large proportions of the population being unbanked is that cash payments prevail. According to Visa’s estimates, $17 trillion in consumer payments are still made with cash globally. The distribution between cash and non-cash (specifically card) payments differs widely from country to country, even in mature markets: in Sweden, cash transactions make up only 15% of in-store payments, compared to 27% in the United Kingdom and 67% in the United Arab Emirates7.

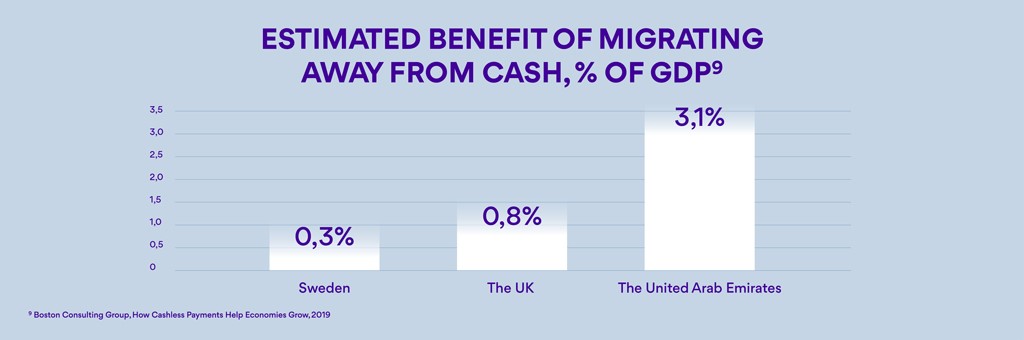

Moving away from cash has many positive effects: fostering financial inclusion, increasing governments’ ability to collect taxes, reducing cash handling for merchants, etc. As a consequence, friction in the overall economy is reduced, which leads to increased spending. This creates a virtuous economic cycle where increased consumption translates into increased production, job creation, higher incomes and overall greater economic prosperity8. In other words, the migration away from cash has a significant impact on GDP: the higher the initial cash usage, the larger the economic impact9.

The transition from unbanked to cardholder is therefore not just about creating convenience and security for users, it also directly impacts the world’s economic development.

1 Brink, Technology’s Role in Financial Inclusion: Hype or Hope?, 2018

2 Wired, Cashless Stores Alienate Customers in the Name of Efficiency, 2019

3 Finextra, Mobile money drives financial inclusion but gender gap persists, 2018

4 Mastercard, New mobile money propositions have the potential to reduce the world’s unbanked population by more than a third, 2019

5 The World Bank, Financial Inclusion on the Rise, But Gaps Remain, Global Findex Database Shows, 2018

6 Business Insider, 2019

7 Global payments report, Worldpay, 2020

8 Moody’s analytics, The Impact of Electronic Payments on Economic Growth, 2016

9 Boston Consulting Group, How Cashless Payments Help Economies Grow, 2019

Latest News