Supporting FinTechs and Neobanks with a dedicated program from onboarding to card issuance

Today, payment card issuers have the tools at their disposal to embrace the environmental aspirations of their customers while also improving their bottom line.

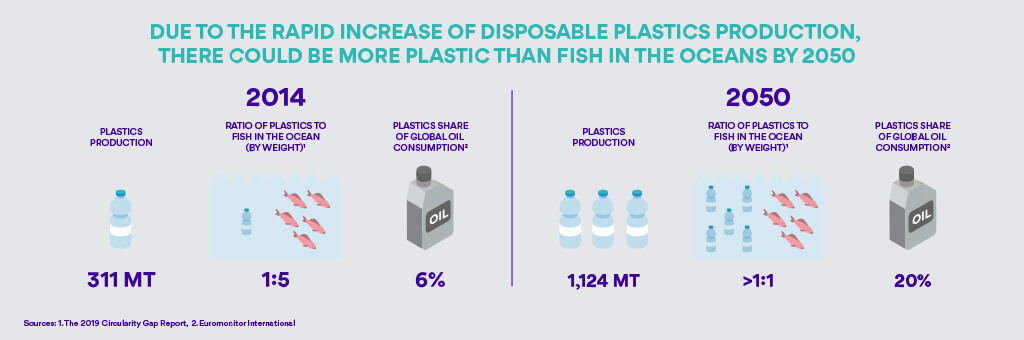

For many years, the world’s economy has been dominated by a take/make/dispose paradigm, the ‘linear economy’, in which our planet’s resources are perceived as endless. A striking example of this attitude is that only 9%1 of the 89 billion2 tons of materials that are extracted from the Earth annually are recirculated. Today, single-use plastics account for 40 percent of the world’s plastic production3. As a result, plastic pollution has become one of the world’s most pressing environmental issues, as the increasing production of disposable plastic products overwhelms our ability to deal with them3. Yet plastics remain the workhorse material of the modern economy and ubiquitous in our everyday lives. Despite increasing awareness about this issue, plastic production is expected to triple in the next 30 years, ultimately leading to there being more plastic than fish in our oceans4.

In light of this, it is clear that the only way to curb this evolution is to change business models, behaviors and consumption models and that rethinking the future of plastics is one of the 21st century’s main challenges. Changes to plastics and plastic recycling will have a major impact on preserving the environment by saving landfill space, reducing oil consumption, saving energy and reducing emissions.

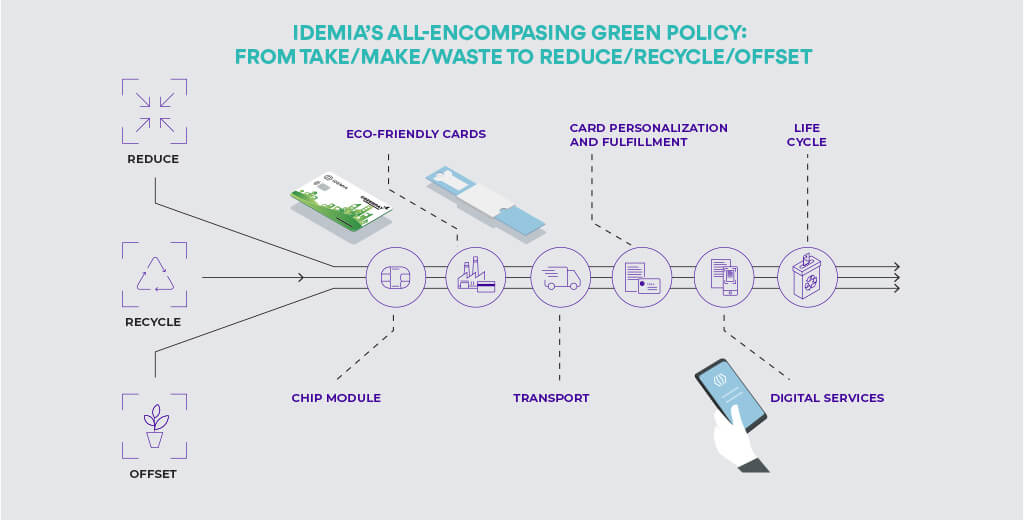

The urgency of these changes is underlined by the cry for sustainable solutions heard all over the world, from mighty organizations such as the UN down to individual consumers, and spurred by accelerating climate changes. The take/make/dispose linear model is being challenged and slowly but surely replaced by a reduce/recycle/offset way of thinking.

What’s more, consumers today are driven by their values more than never before. They want products that are compatible with their lifestyles and to engage with organizations that share their values. And they’re often willing to pay a premium for a product that fits their values. A Cone/Porter Noveli study found that 79% of Americans are more loyal to purpose-driven brands whose values they share5. Concerning environmental issues, a strategy guide from Nielsen states that 81% of global consumers think it’s extremely important that companies implement programs to improve the environment and that 73% would change their consumption habits to reduce their impact on the environment6.

This strong stance has not gone unnoticed: in an Accenture and UN study, 94% of CEOs of major global companies say that sustainability issues are important to the future success of their business7. When this translates into concrete actions, we see a major supermarket chain in the UK offering savings to shoppers who return shopping bags, one of the world’s main internet giants installing solar farms and a leading sportswear brand launching vegetable shoes made of waste from wine production. As for consumers, they are clearly rewarding eco-conscious business: in 2015, another sportswear brand launched a limited edition of sneakers (7,000 pairs) made of recycled plastics8, which went on to sell 1 million pairs in just over a year9. And since these sneakers are typically sold in the €150-200 range, this huge success confirms the premium consumers are willing to pay for products that correspond to their values. Furthermore, a NYU Stern study showed that sales of consumer packaged goods (packaged food, beverages and cosmetics) marketed as sustainable have been growing more than five times faster than conventional products10.

These changes affect the world of payment solutions as well. A global survey by Dentsu11 recently showed that consumers are conscious regarding payments11, with a massive 87% expecting their banks to offer eco-friendly cards. In fact, 62% would even consider switching to an eco-conscious bank. Furthermore, as mentioned above, products with an environmental benefit can often justify a higher price tag: the survey showed that 74% of millennials around the world, who are the number one source of income, spending and wealth creation globally since 201512, would accept a monthly additional fee for a “green” card.

Simultaneously, the payment card has arguably become the last remaining physical touchpoint between card issuers and their customers, as visits to bank branches and paper account statements have dramatically decreased or disappeared altogether. In light of this, the Big- and FinTechs have realized what a formidable marketing tool the physical card is (“a marketing and branding moment that replays every time a customer takes out his or her card”13), and are leading the way in leveraging the payment card with innovative materials with groundbreaking designs. At the same time, consumers are increasingly seeing their cards as accessories and an extension of themselves. Therefore, given the payment card’s high visibility and prominent position as a carrier of the bank’s identity, an eco-friendly card will elevate the value of the brand in the eyes of environmentally conscious consumers.12

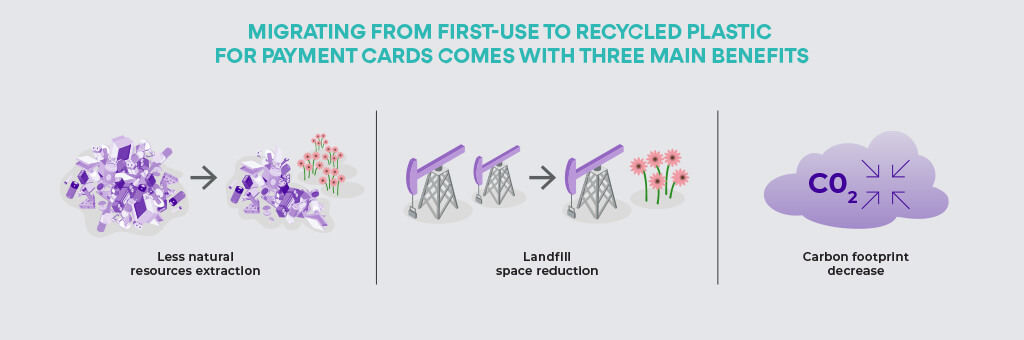

To support banks and other card issuers in this transformation, IDEMIA has developed the GREENPAY card range, made out of recycled PVC that passes all the ISO tests to guarantee the same level of quality and durability as first-use PVC. These cards are fully available today, and the next generation, which will use bio-sourced materials to eliminate dependence on fossil fuels, is in preparation. Migrating from first-use to recycled plastic comes with three main benefits:

Environmental issues are eminently global and transversal. Beyond the payment card itself, eco-conscious customers have come to expect green initiatives all along the payment value chain. As an illustration, 65% of consumers expect banks to offer digital alternatives to paper documents, and 71% think banks should provide a recycling service for expired payment cards11.

Consequently, making payment card bodies out of an eco-friendly material is a good start, but not enough. A holistic approach of the entire value chain is better: from reducing the carbon footprint of manufacturing sites to implementing eco-designed packaging, replacing paper with digital services and recycling expired cards. All these are solutions and services that are part of IDEMIA’s GREENPAY global approach. For example, our on-demand card printing service avoids obsolete inventory: this is not only better for the planet, it also enables issuers to reduce the budget for card carriers by 20%. Similarly, by reducing paper-based communication thanks to our digital PIN solution, banks can not only cut down on the cost of postal emissions, they also significantly reduce their carbon footprint. Lastly, all GREENPAY products and services fund environmental projects around the world, in line with the United Nations’ Sustainable Development Goals.

Today, going green is no longer optional, for the banking industry like for all other economic sectors. Banks and other card issuers that contribute to the transition from a linear to a circular economy are not only taking their responsibility from an ethical point of view, they are also aligning with the expectations of their customers, who will ultimately decide which brands flourish or wither.

1 The 2019 Circularity Gap Report

2 Euromonitor International

3 National Geographic, The world’s plastic pollution crisis explained, 2019

4 World Economic Forum, The New Plastics Economy, 2016

5 Cone/Porter Novelli, Purpose Study, 2018

6 Nielsen, Sustainable shoppers, 2018

7 United Nations, Accenture, The decade to deliver, 2019

8 The Inertia, Adidas and Parley Up the Ante With Recycled Ocean Waste Shoes in 2019; Vow to Make 11 Million Pairs, 2019

9 CNBC, Adidas sold 1 million shoes made out of ocean plastic in 2017, 2018

10 NYU Stern, Sustainable Share Index™: Research on IRI Purchasing Data (2013-2018), 2019

11 Global study independently led by “Data 2 decisions” (Dentsu Aegis Network), encompassing 2,800 people in 10 countries, 2020

12 Telstra, Millennials, Mobiles & Money, 2015

13 icma, 2020 Card Trends

14 pymnts, Mastercard Promoting Sustainable Credit Cards, 2020

Latest News